charitable gift annuity calculator

The information you enter below will be kept completely confidential. Legal Name Address and Tax ID Catholic Relief Services - USCCB 228 West Lexington Street Baltimore Maryland 21201-3443 Federal Tax ID.

Charitable Gift Annuity American Red Cross Help Those Affected By Disasters

Calculate the benefits of a gift annuity with our gift calculator in the next tab.

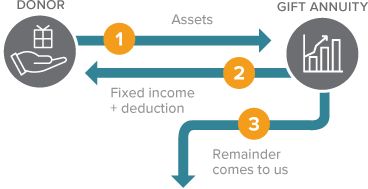

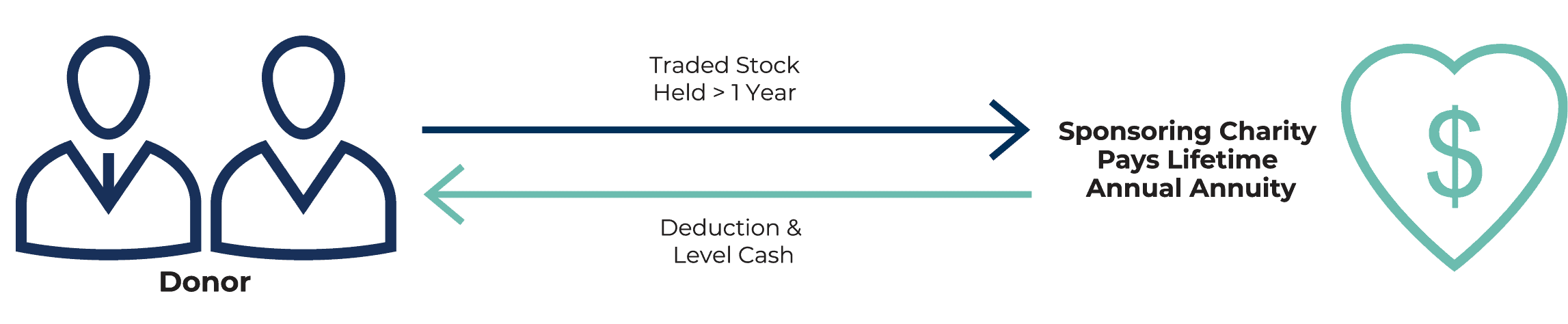

. You make an irrevocable gift of cash securities or other property to your charitable fund held at Thrivent Charitable Impact Investing. Wills Trusts and Annuities Home Why Leave a Gift. Complete the form below to calculate your income for life and tax benefits or contact our gift planning team at 800-922-1782 or email.

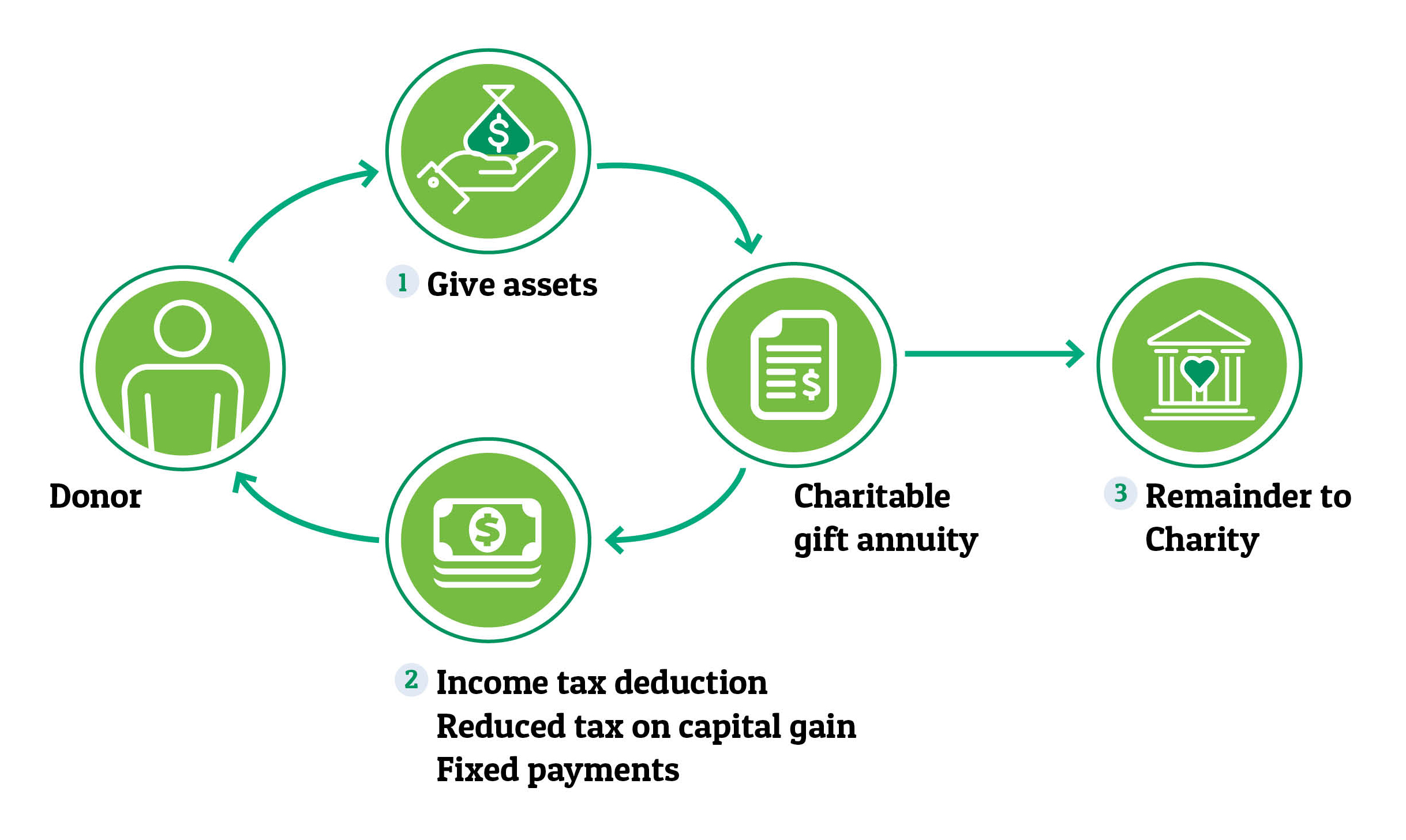

Current gift annuity rates are 49 for donors age 60 6 for donors age 70 and 77 for donors age 80. This means that the gift annuity rate displayed by the GiftCalcs planned gift calculator tool is likely to exceed New York maximum rates. In return the Foundation provides fixed payments to one or two individuals for life.

Use this calculator to estimate the benefits you could enjoy with a CRS Charitable Gift Annuity plan. Please click the button below to open the calculator. To determine how a gift or estate planning decision might affect your particular circumstances it is expressly.

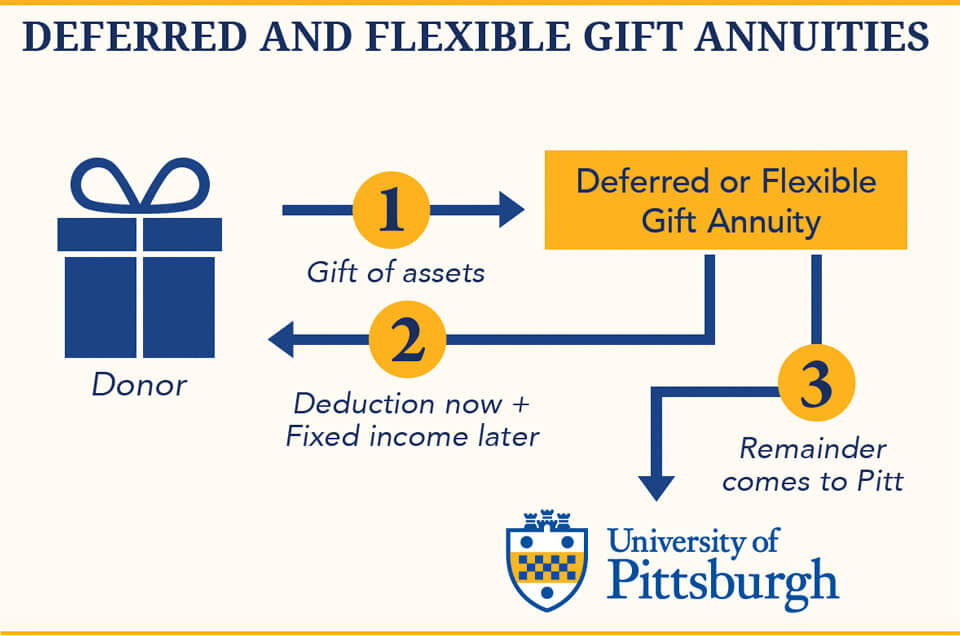

Benefit from fixed payouts beginning at a date of your choosing more than one year after the gift. You can contribute cash or securities to Consumer Reports for a charitable gift annuity and in return receive fixed-rate lifetime annuity payments and a. Complimentary Planning Resources Are Just a Click.

Calculate Sale and unitrust. Income rates are based on your age or the age of your beneficiary at the time payments commence. Receive fixed payments with tax free sale plus charitable tax deduction.

After this time the remainder of the annuity will benefit whatever area of Texas AM you wish. Wondering if a Charitable Gift Annuity or a Charitable Remainder Trust is right for you. Enjoy substantial cash and save 50 70 or even 100 of tax on gain.

Just click the Recalculate my Benefits button. For example if you created a 100000 gift annuity at age 70 you could expect to receive 4700 in payments each year. By making a charitable gift annuity you can provide much-needed funds for conservation and provide yourself with a stable income.

Charitable Gift Annuity Calculator. That rate is also based on your age as well as the age of the other beneficiary. Simply input the amount of your possible gift the basis of the property and the ages of the planned income recipients.

By pooling these life income gifts we can create investment compliance administration and risk management efficiencies to maximize the final grants to your favorite charites. Use our handy Gift Calculator. Our gift calculators show you how a gift to the American Heart Association provides benefits to you and your loved ones while continuing to fight heart disease and stroke.

The National Gift Annuity Foundation offers immediate deferred and flexible gift annuity structures allowing you to meet your lifetime income payment needs. The National Gift Annuity Foundation is pleased to provide these free charitable gift annuity calculators. 13-5563422 Contact the Planned Giving Team Dont see what you need.

A contract between you and the Texas AM Foundation a charitable gift annuity can be created with a 10000 minimum gift of cash or securities. This calculator estimates the federal income tax deduction for a donor s based on parameters you specify. Calculate Part gift and part sale.

A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with. Your calculation above is an estimate and is for illustrative purposes only. Ways to Gift.

Want to try again with new numbers. Input a few details and see how a charitable gift annuity can benefit you. Charitable Gift Annuity Calculator.

The results will provide an overview of benefits including payout details deduction. Provide your basic information and receive an estimate of future income and charitable deductions. Or for a personalized proposal contact us today.

Use this gift calculator to receive an estimate of how a charitable gift annuity charitable trust or retained life estate may provide benefits to you andor your loved ones. It does not constitute legal or tax advice. In exchange your fund pays you a fixed amount each year for the rest of your life.

A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department. Use this free no-obligation tool to find the charitable gift thats right for you. Use our online form to get in touch.

The calculator below determines the charitable deduction for any of the following gift types. Gift Annuity - Youll receive fixed annual payments for. The payment rate for joint gift annuities is lower than the rate for single gift annuities.

The gift planning information presented on this site is intended as general. Tax accounting or other professional advice. Calculate Deferred gift annuity.

Need help calculating expected income from a charitable gift annuity. Rates for a Charitable Gift Annuity funded July 1 2018 or later. Input your info below to see a personalized example of your projected payments and tax benefits.

The ACGAs current suggested maximum payout rates exceed the current maximum payout rates allowed by the State of New York at the ages of most gift annuitants. American Heart Associations Tax Identification Number. Contact your Charitable Estate Planning Representative to discuss your options.

Turn Your Generosity Into Lifetime Income The Los Angeles Jewish Home

Charitable Gift Annuity Focus On The Family

Charitable Gift Annuities National Wildlife Federation

Charitable Gift Annuities The University Of Pittsburgh

Gifts That Pay You Income Moffitt Cancer Planned Giving

Charitable Gift Annuities Giving To Duke

Charitable Gift Annuity Tax Deductions Cga Rates Ren

Planned Giving Calculator Harvard Alumni

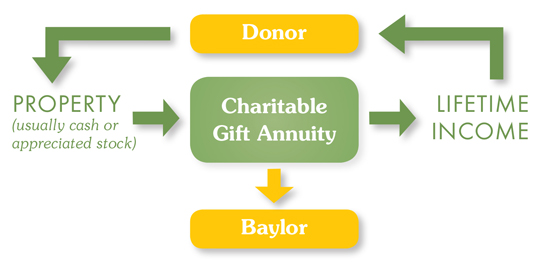

Baylor University Giving To Baylor How You Can Give Gift Annuity

Charitable Remainder Annuity Trusts Giving To Stanford

Charitable Gift Annuities Uchicago Alumni Friends

Charitable Gift Annuities Barnabas Foundation

Charitable Gift Annuities The University Of Chicago Campaign Inquiry And Impact

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuity Immediate University Of Virginia School Of Law

Charitable Gift Annuities University Of Montana Foundation University Of Montana

Gift Calculator Museum Of Fine Arts Boston